- 인○○트

- 02-26

- 썬○○○

- 02-25

- 서○○드

- 02-23

- 올○○유○

- 02-23

- 모○○스

- 02-20

- 디○○코○○

- 02-10

- 모○○랩

- 02-06

- 사○○

- 02-06

- 왓○○컴○○

- 02-05

- 에○○엠○○

- 01-27

- ○뜻○하○

- 01-27

- 평○화○지○지역주택

- 01-26

- 월○

- 01-21

- 한○장○○재○○○

- 01-19

- ○한○○

- 01-13

- 루○에○

- 01-06

- 웨○○코

- 01-05

- 썬○○○

- 12-30

- 한○영○○○○교○○

- 12-30

- 루○호○○○○○

- 12-29

- ○스○오

- 12-24

- 디○○프○○

- 12-19

- ○랜○코○○○○○○

- 12-18

- 왓○○○○○

- 12-15

- 식○명○○○○

- 12-11

- 위○○

- 12-05

- 르○○르

- 12-04

- 법○사○○○○

- 12-02

- 이○○컴○○

- 12-01

- 주○○○○래

- 11-26

- 서○○○○○○

- 11-25

- ○○프

- 11-24

- 제○○드○○

- 11-21

- 목○○○○○

- 11-19

- ○이○○○○○

- 11-18

- ○티○○○○○○

- 11-18

- ○이○○○

- 11-18

- 주○○○○래

- 11-11

- 한○○○○○○차○○

- 11-11

- 와○○에○○

- 11-10

- ○○한○○

- 11-10

- ○트○○○○

- 11-07

- 올○○유○

- 11-07

- 크○○○

- 11-04

- 왓○○○○니

- 11-04

- 인○잇○○○

- 11-04

- 데○○○

- 11-03

- ○○시○

- 10-15

- 파○○○디○

- 10-01

- ○임○○○센○

- 09-26

- 266,246

-

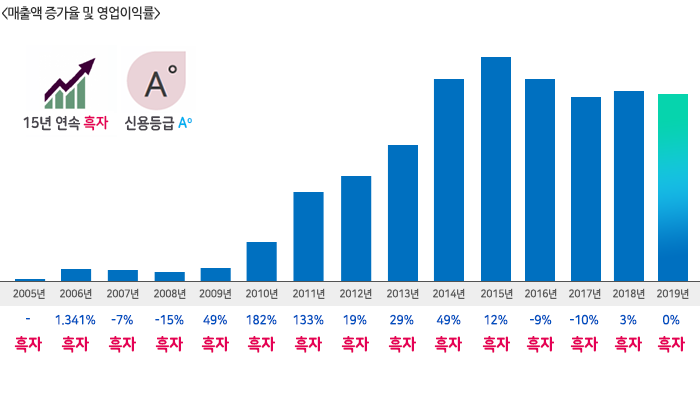

• 성장성 재무지표 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 총자산증가율 17.42% 73.05% 203.52% 63.05% 30.98% 44.61% -9.36% 56.42% 27.37% 10.08% 유형자산증가율 15.76% 72.76% 1935.60% 139.11% -3.01% 0.23% 94.17% 72.35% 40.16% -0.99% 유동자산증가율 16.79% 33.85% 15.62% 17.87% 87.36% 79.87% -58.78% 26.79% -10.59 62.76 총자본증가율 17.42% 73.05% 203.52% 63.05% 30.98% 44.61% -9.36% 56.42% 27.37% 10.08% 매출액증가율 48.71% 181.81% 132.80% 18.65% 28.91% 46.71% 12.18% -9.78% -10.68% 3.40% • 수익성 재무지표 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 총자산순이익률 3.92% 15.57% 19.24% 15.36% 16.19% 23.41% 18.52% 8.71% 3.27% 9.93% 기업순이익률 6.10% 16.77% 19.65% 16.09% 17.49% 24.27% 19.41% 9.17% 4.15% 11.42% 자기자본순이익률 10.17% 41.14% 60.67% 39.86% 35.48% 42.59% 48.89% 26.51% 11.26% 27.33% 자본금순이익률 7.5% 51.6% 193.6% 251.9% 347.9% 727.3% 521.6% 383.45% 183.53% 613.02% 매출액순이익률 2.91% 7.10% 11.44% 12.54% 13.44% 19.15% 12.24% 9.97% 5.34% 17.27% 매출액영업이익률 3.36% 7.29% 11.99% 14.01% 14.15% 22.11% 14.92% 11.90% 5.82% 15.31% • 안정성 재무지표 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 자기자본비율 38.56% 37.86% 31.71% 38.56% 45.63% 54.96% 37.89% 32.84% 29.06% 36.32% 유동비율 138.19% 117.75% 148.96% 154.71% 214.11% 298.54% 220.59% 347.57% 272.15% 568.59% 비유동비율 42.61% 32.11% 147.03% 161.84% 101.28% 60.22% 183.62% 229.39% 284.73% 204.84% 부채비율 159.33% 164.16% 215.32% 159.36% 119.16% 81.95% 163.92% 204.49% 244.17% 175.32% 차입금의존도 40.16% 23.21% 36.36% 41.83% 31.94% 28.36% 47.63% 59.63% 61.85% 56.19%